Consubanco is a commercial bank that specializes in providing short-term consumer loans and credit cards primarily to employees and pensioners of Mexico’s public sector. These loans are repaid primarily through deductions from paychecks or pension payments—a type of credit that’s often called a “Payday Loan”.[1]

Payday loans sound like a great deal: Low-wage workers are able to access credit and the payments are just taken directly from their salary, so they don’t have to worry about defaulting because they have forgotten to pay. In addition, the loans are negotiated between the employer (or Mexican union) and the bank, so all the borrower has to do is sign up and the details are already taken care of.

The catch is that these loans are offered at very high interest rates; in fact, according to CONDUSEF,[2] the agency that regulates consumer loans in Mexico, Consubanco charges a whopping 71.44% quarterly interest on the personal loans it issues, along with a 1% service charge.[3]

It’s possible to search the CONDUSEF website directly to see the different loan products offered, and when we checked, we confirmed that Consubanco currently offers its personal loans at 71.44%.[4] To put this in real terms, if you borrow $5000 through these programs and agree to pay the loan back in five years, you could end up paying a total of $18,434 over the five years of the loan![5]

However, 71% is the good news for consumers. Consupago, a subsidiary of Consubanco, is now charging an interest rate of 105%.[6] That means that your $5000 loan will cost you $26,422 by the time you’ve paid it off five years later.[7] Even if you choose to pay it back in a year, you’re still going to be paying $8274.[8] In comparison, other banks, such as Banorte, offer similar products at 45% interest,[9] which is by no means cheap–but is still significantly less than Consubanco.

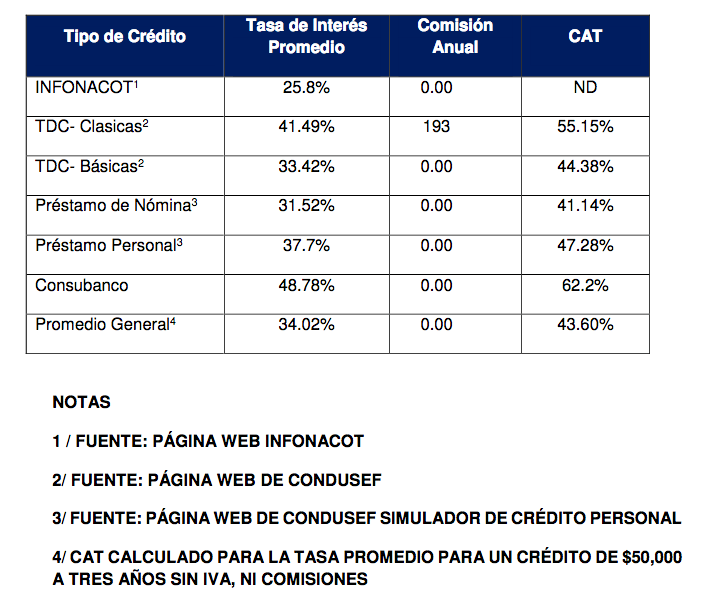

These loan rates seem to be trending upwards. In its 2015 Annual Report filed with the CNBV (Comisión Nacional Bancaria y de Valores, similar to the SEC in the US) in April 2016, Consubanco revealed that its average interest rate last year was 48.78%, with an annual cost of 62.2%–significantly higher than INFONACOT and other lenders.[10]

While Consubanco and the Chedraui family might believe that they’re benefitting low-wage Mexican workers, the realities of these loans may present as many challenges as benefits.

Consubanco regulatory documents: Annual report 2015 Second quarter 2016 report

[1] https://www.consubanco.com/Consubanco/Index

[2] CONDUSEF, the Mexican National Commission for the Protection and Defense of Financial Services Users (Comisión Nacional para la Protección y Defensa de los Usuarios de Servicios Financieros)

[3] https://www.gob.mx/cms/uploads/attachment/file/118683/CREDITO_AL_CONSUMO_n_mina_personal_auto_2016.pdf

[4] http://ifit.condusef.gob.mx/ifit/ft_general_final.php?idnc=11421&t=9&b=1

[5] http://www.calculator.net/amortization-calculator.html?cloanamount=5000&cloanterm=5&cinterestrate=71&printit=0&x=76&y=24

[6] http://ifit.condusef.gob.mx/ifit/ft_general_final.php?idnc=7488&t=9&b=1

[7] http://www.calculator.net/amortization-calculator.html?cloanamount=5000&cloanterm=5&cinterestrate=105&printit=0&x=37&y=8

[8] http://www.calculator.net/amortization-calculator.html?cloanamount=5000&cloanterm=1&cinterestrate=105&printit=0&x=53&y=10

[9] http://ifit.condusef.gob.mx/ifit/ft_general_final.php?idnc=475&t=9&b=1

[10] Annual report 2015, page 15